GameStop Corp.(NYSE: GME) once a struggling brick-and-mortar video game retailer has become one of the most talked-about stocks in recent years.

The GameStop saga that unfolded in 2021 captured the attention of investors regulators and the general public alike transforming the company into a symbol of retail investor power and market volatility

.As we delve into 2024, the GME stock continues to be a subject of intense scrutiny and debate in financial circles.

The GameStop Saga:A Brief History

The GameStop story began in earnest in 2020 when a group of retail investors primarily coordinating through the Reddit forum r/WallStreetBets identified GME as a potential target for a short squeeze.

At the time GameStop was heavily shorted by institutional investors who believed the company’s business model was outdated and doomed to fail in the face of digital game distribution.

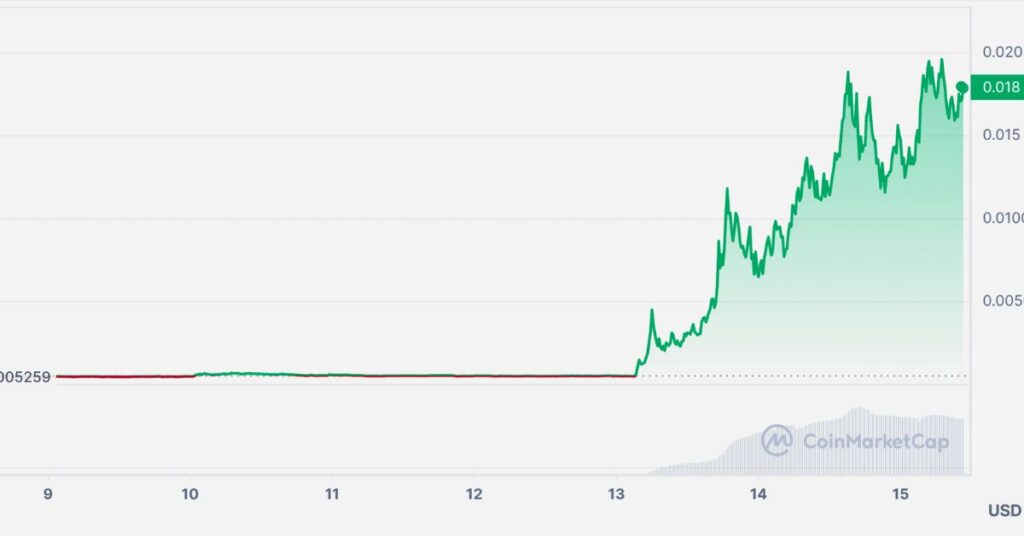

In January 2021 the situation came to a head as retail investors began purchasing large quantities of GME stock driving up the price and forcing short sellers to cover their positions.

This led to a dramatic surge in the stock price, with GME reaching an all-time high of $483 per share on January 28, 2021 up from just $17.25 at the beginning of the month.

The unprecedented price action led to controversy with some brokerages restricting trading in GME and other volatile stocks.This move drew criticism and sparked debates about market fairness and the role of retail investors in the financial system.

Read This Blog:All Access Technologies 402-699-2575: Your Gateway to Cutting-Edge Security Solutions

GME Stock Performance in 2024

As we enter 2024 the GME stock continues to exhibit significant volatility though not at the extreme levels seen during the 2021 short squeeze.

The stock price has stabilized somewhat but remains subject to rapid fluctuations based on various factors including company news market sentiment and broader economic conditions.

Key Performance Metrics

- Year-to-date return

- 52-week high and low

- Average daily trading volume

- Market capitalization

It’s important to note that these metrics are constantly changing and investors should always refer to the most up-to-date information when making investment decisions.

Factors Influencing GME Stock In 2024

Several factors continue to impact GME stock performance in 2024:

1. Company Fundamentals

GameStop’s financial health and business performance remain crucial factors in determining its stock price.Investors closely monitor:

- Quarterly earnings reports

- Revenue growth

- Profit margins

- Debt levels

- Cash flow

The company’s ability to execute its transformation strategy and adapt to the changing retail landscape is particularly important.

2. Retail Investor Sentiment

The influence of retail investors on GME stock cannot be overstated. Social media platforms like Reddit Twitter and Discord continue to play a significant role in shaping sentiment around the stock.Positive buzz can lead to buying pressure while negative sentiment can trigger sell-offs.

3. Short Interest And Institutional Holdings

The level of short interest in GME stock remains a key factor as high short interest could potentially lead to another short squeeze.Additionally changes in institutional holdings can signal shifts in professional investor sentiment towards the company.

4. Regulatory Environment

The evolving regulatory landscape surrounding meme stocks and retail trading continues to impact GME stock.Any new regulations or statements from bodies like the SEC can have immediate effects on the stock price and trading patterns.

GameStop’s Business Strategy And Future Outlook

In 2024, GameStop continues to pursue its transformation strategy focusing on:

- Expanding its e-commerce presence

- Diversifying product offerings beyond video games

- Optimizing its brick-and-mortar store network

- Exploring opportunities in emerging technologies like blockchain and NFTs

The success of these initiatives will play a crucial role in determining the company’s long-term viability and consequently its stock performance.

Read This Blog:RealizePad.Store: Your Digital Note-Taking Experience

Risks And Opportunities For Investors

Investing in GME stock in 2024 presents both significant risks and potential opportunities:

Risks:

- High volatility

- Uncertain business transformation outcomes

- Intense competition in the gaming and e-commerce sectors

- Regulatory scrutiny

Opportunities:

- Potential for high returns if the company’s transformation succeeds

- Possibility of short-term gains from market volatility

- Exposure to emerging technologies in gaming and retail

Expert Opinions And Analyst Recommendations

Analyst opinions on GME stock remain divided in 2024.Some view the company’s transformation efforts positively and believe in its long-term potential while others remain skeptical about its ability to compete in the digital age.

It’s important to note that analyst recommendations can vary widely and change frequently based on new information and market conditions.Investors should consider multiple sources and conduct their own research before making investment decisions.

GME Stock Investment:Key Risk Factors

When considering an investment in GME stock it’s crucial to be aware of the following risk factors:

- Market volatility:GME stock is known for its extreme price swings, which can lead to significant gains or losses in short periods.

- Speculative nature:Much of the stock’s value is based on future expectations rather than current fundamentals.

- Competitive pressures:The video game retail industry faces intense competition from digital distribution platforms and e-commerce giants.

- Regulatory risks:Increased scrutiny from regulators could impact trading patterns and market dynamics.

- Execution risk:The success of GameStop’s transformation strategy is not guaranteed and faces numerous challenges.

How To Stay Informed About GME Stock

To make informed decisions about GME stock investors should:

- Follow official company announcements and financial reports

- Monitor reputable financial news sources for market analysis and expert opinions

- Keep an eye on social media sentiment, particularly on platforms like Reddit and Twitter

- Utilize stock screening tools and financial databases for up-to-date metrics and comparisons

- Consider subscribing to analyst reports or financial newsletters for in-depth analysis

Informed Decisions About Investing In GME Stock

When considering an investment in GME stock it’s essential to:

- Conduct thorough research on the company’s fundamentals and future prospects

- Understand your risk tolerance and investment goals

- Diversify your portfolio to manage risk

- Stay informed about market trends and regulatory developments

- Consider consulting with a financial advisor for personalized guidance

Remember that past performance does not guarantee future results and investing in individual stocks carries inherent risks.

Frequently Asked Questions

What Is FintechZoom GME Stock?

FintechZoom GME Stock refers to GameStop Corp.stock as discussed on the financial news website FintechZoom.It’s not a separate stock but rather analysis and coverage of GME stock on this platform.

Why Did GME Stock Become Famous?

GME Stock gained notoriety in 2021 due to a massive short squeeze orchestrated by retail investors leading to unprecedented price volatility and sparking debates about market dynamics.

Is GME Stock A Good Investment?

The suitability of GME Stock as an investment depends on individual risk tolerance and market conditions.It’s known for high volatility and should be approached with caution.

What Is GME Stock Doing To Grow Its Business?

GME is focusing on e-commerce expansion diversifying product offerings optimizing its store network and exploring opportunities in emerging technologies like blockchain.

Where Can I Find More Information About GME Stock?

Information about GME Stock can be found on financial news websites the company’s investor relations page SEC filings and through reputable financial data providers.

The Final Words

GME stock remains a volatile and closely watched investment in 2024.Its performance continues to be influenced by retail investor sentiment company transformation efforts and market dynamics.While opportunities exist investors should approach GME with caution and thorough research.

William is a passionate fashion enthusiast with a keen eye for style trends.

With a background in textile design and years of experience in the Tech industry, William brings a unique perspective to his writing. He loves exploring sustainable fashion and street style.