Understanding the CAC40 Index

The CAC40 (Cotation Assistée en Continu 40) is France’s premier stock market index, representing the 40 most significant values among the top 100 market capitalization companies on the Euronext Paris. Established in 1987, the CAC40 has become a crucial benchmark for the French economy and a key indicator of market trends in Europe.

Key Components of the CAC40

The CAC40 comprises a diverse range of companies across various sectors, reflecting the breadth of the French economy. Some of the notable components include:

- Luxury goods:LVMH, Kering, Hermès

- Energy:Total Energies

- Aerospace and defense:Airbus, Safran

- Banking and finance:BNP Paribas, Société Générale

- Technology:Capgemini, Dassault Systèmes

These companies are selected based on factors such as market capitalization, free float, and trading volume. The index is reviewed quarterly to ensure it accurately represents the most influential companies in the French market.

The Role of FintechZoom in CAC40 Analysis

FintechZoom has emerged as a powerful tool for investors, analysts, and traders seeking to gain deeper insights into the CAC40 index and its constituent companies. As a cutting-edge financial technology platform, FintechZoom offers a comprehensive suite of analytical tools and real-time data that enable users to make informed decisions in the fast-paced world of stock trading.

Read This Blog:Understanding FintechAsia Error Codes: Common Issues And Solutions

Key Features of FintechZoom for CAC40 Analysis

- Real-time data:FintechZoom provides up-to-the-minute price quotes, trading volumes, and market depth for all CAC40 stocks.

- Technical analysis tools:Users can access a wide range of charting options, including candlestick patterns, moving averages, and momentum indicators.

- Fundamental analysis:The platform offers detailed financial statements, key ratios, and earnings reports for CAC40 companies.

- News aggregation:FintechZoom collates relevant news and market sentiment data, helping users stay informed about factors affecting the CAC40.

- Emerging Trends in CAC40 Companies:Advanced users can develop and backtest trading strategies using FintechZoom’s powerful algorithms.

Impact of FintechZoom on CAC40 Trading Strategies

The integration of FintechZoom into CAC40 analysis has revolutionized trading strategies for both institutional and retail investors. By leveraging big data and artificial intelligence, FintechZoom enables users to:

- Identify market trends and patterns more quickly and accurately

- Develop more sophisticated risk management strategies

- Optimize portfolio allocation based on real-time market conditions

- Execute trades with greater precision and speed

- Gain insights into market sentiment and investor behavior

These capabilities have led to more dynamic and responsive trading strategies, allowing investors to capitalize on short-term market movements while maintaining a long-term perspective on the CAC40’s performance.

Read This Blog:Top 15 Soap2day Alternatives: Watch The Latest Hits Of Movies And Series For Free

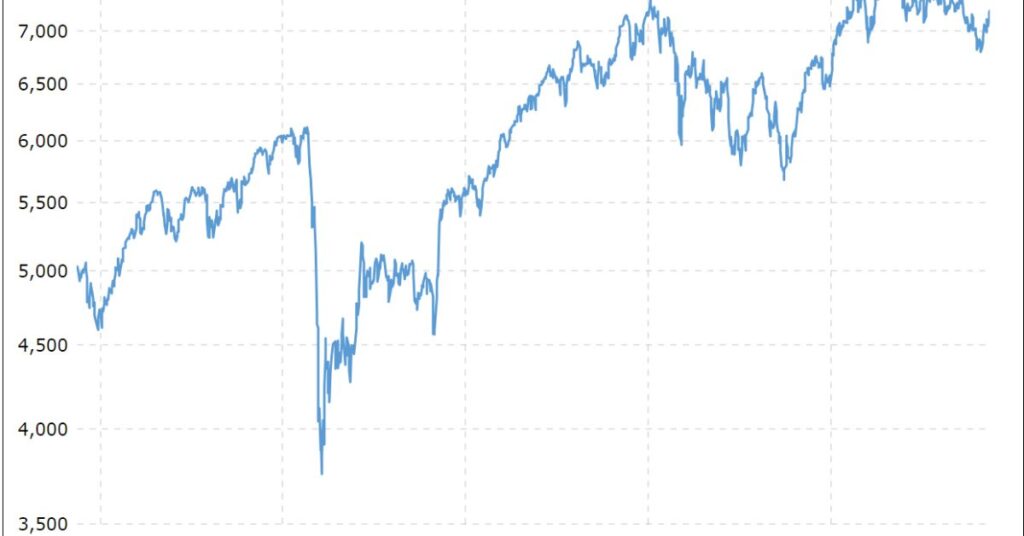

CAC40 Performance in 2024: A FintechZoom Perspective

As of 2024, the CAC40 has shown remarkable resilience and growth, despite ongoing global economic challenges. FintechZoom’s analysis reveals several key trends:

- Technology sector outperformance:Companies like Capgemini and Dassault Systèmes have driven significant gains, reflecting the growing importance of digital transformation across industries.

- Recovery in luxury goods:LVMH, Kering, and Hermès have bounced back strongly, benefiting from pent-up demand and the reopening of global markets.

- Green energy transition:Total Energies and other energy-sector companies have made strides in renewable energy investments, positively impacting their stock performance.

- Banking sector stabilization:After a period of uncertainty, major banks like BNP Paribas have shown improved profitability and asset quality.

- Aerospace rebound:Airbus and Safran have seen a resurgence in orders as global air travel recovers.

FintechZoom’s advanced analytics have enabled investors to identify these trends early and adjust their portfolios accordingly, leading to enhanced returns for many CAC40-focused strategies.

Read This Blog:Immediate 1000 ProAir: The Ultimate Solution For Clean And Fresh Air

Emerging Trends in CAC40 Companies

FintechZoom’s data analysis has highlighted several emerging trends among CAC40 companies:

- Increased focus on ESG (Environmental, Social, and Governance) factors

- Acceleration of digital transformation initiatives

- Expansion into emerging markets, particularly in Asia and Africa

- Investment in artificial intelligence and machine learning technologies

- Adoption of circular economy principles and sustainable business practices

These trends are reshaping the competitive landscape and driving innovation across the CAC40, with potential long-term implications for investors and the broader French economy.

Challenges and Opportunities for CAC40 Companies

While the outlook for CAC40 companies remains positive, they face several challenges:

- Global supply chain disruptions

- Inflationary pressures and rising input costs

- Regulatory changes, particularly in areas like data privacy and environmental standards

- Talent acquisition and retention in a competitive global market

- Cybersecurity threats and digital resilience

However, these challenges also present opportunities for innovation and growth. FintechZoom’s predictive analytics help investors identify which companies are best positioned to navigate these challenges and capitalize on emerging opportunities.

FintechZoom’s Role in Investor Education

Beyond its analytical capabilities, FintechZoom has played a crucial role in democratizing access to financial information and education. The platform offers:

- Educational resources on CAC40 analysis and trading strategies

- Webinars and expert interviews featuring insights from leading market analysts

- Community forums for discussion and knowledge sharing

- Paper trading features for risk-free practice

- Personalized learning paths for users of varying experience levels

This focus on education has empowered a new generation of retail investors to participate in CAC40 trading with greater confidence and knowledge.

The Future of CAC40 Analysis with FintechZoom

Looking ahead, FintechZoom is poised to further revolutionize CAC40 analysis through:

- Enhanced AI-driven predictive models

- Integration of alternative data sources, such as satellite imagery and social media sentiment

- Advanced natural language processing for real-time news analysis

- Virtual and augmented reality tools for data visualization

- Blockchain-based solutions for transparent and secure trading

These innovations promise to provide even deeper insights into the CAC40, enabling more sophisticated investment strategies and risk management techniques.

Key Benefits of Using FintechZoom for CAC40 Analysis

- Comprehensive data coverage:Access to a wide range of financial and non-financial data points for all CAC40 companies.

- Time-saving automation:Automated reports and alerts streamline the analysis process.

- Customizable dashboards:Users can tailor their interface to focus on the metrics most relevant to their investment strategy.

- Multi-asset class analysis:Ability to analyze correlations between CAC40 stocks and other asset classes.

- Collaborative features:Tools for sharing insights and collaborating with team members or clients.

CAC40 FintechZoom: Key Statistics for 2024

- Total market capitalization of CAC40:€2.3 trillion

- Average daily trading volume:€5.2 billion

- Year-to-date index performance:+12.3%

- Dividend yield:3.2%

- Price-to-earnings ratio:18.5

- Top-performing sector:Technology (+18.7%)

- Most improved company:[Company name] (+45.2%)

- Number of FintechZoom users analyzing CAC40:250,000+

- Average time spent on FintechZoom CAC40 analysis:2.5 hours per day

Frequently Asked Questions

What is the CAC40 index?

The CAC40 is France’s benchmark stock market index, representing the 40 most significant companies listed on the Euronext Paris by market capitalization and liquidity.

How does FintechZoom enhance CAC40 analysis?

FintechZoom provides real-time data, advanced analytical tools, and AI-driven insights that enable more comprehensive and timely analysis of CAC40 stocks and trends.

Can individual investors use FintechZoom for CAC40 trading?

Yes, FintechZoom offers tools and resources suitable for both institutional and retail investors interested in CAC40 trading.

How often is the CAC40 index composition reviewed?

The CAC40 index composition is reviewed quarterly to ensure it accurately represents the most significant companies in the French market.

What are the key sectors represented in the CAC40?

Key sectors in the CAC40 include luxury goods, energy, aerospace, banking, and technology, reflecting the diverse nature of the French economy.

Final Words

The CAC40 index, a key measure of French economic health, has found a powerful ally in FintechZoom. This innovative platform provides investors with cutting-edge tools and real-time data, revolutionizing how we analyze and trade CAC40 stocks. As we move through 2024, the synergy between the CAC40 and FintechZoom continues to shape the future of investing in France’s leading companies.

William is a passionate fashion enthusiast with a keen eye for style trends.

With a background in textile design and years of experience in the Tech industry, William brings a unique perspective to his writing. He loves exploring sustainable fashion and street style.